Odds are, you will need your car. You would like it to get to operate, to generate your Youngsters all around, to go grocery buying. Scrolling in the Upsolve Consumer Facebook Group confirms that having the ability to purchase a motor vehicle after bankruptcy is often a be concerned For most.

It should really. Amongst the most significant black marks on the credit history rating is obtaining late or skipped payments, and consolidating all of your personal debt into one particular regular payment causes it to be extra possible you'll pay punctually.

This could assist you get accepted for a automobile personal loan at a lessen desire amount. A secured bank card, credit-builder mortgage or becoming a licensed consumer on an acquaintance or member of the family’s charge card could all support you start to rebuild your credit history.

Lenders support customers borrow revenue for many different needs, rather than astonishingly, just one of these factors is to buy a auto. In reality, mainly because cars and trucks, bikes, along with other modes of transportation have become so integral to everyday life, automobile financial loans penned specifically for their purchase are now one of the preferred kinds of funding available—even for individuals with lousy credit.

In lieu of owning many bank card charges and other accounts to pay for, usually with particularly high curiosity fees, financial debt consolidation lessens those individual debts into only one payment each and every month.

For more than twenty five yrs, CuraDebt has assisted people today get on top of the things they owe by means of various bankruptcy possibilities. You simply pay out expenses Once your debts are taken care of, and you simply'll try this out continue to preserve a lot of money.

If you have view website an automobile personal loan that you're up-to-day on if you file Chapter 7 bankruptcy and it’s not a hardship to maintain making payments, you could probably keep the vehicle – if you need to.

Upsolve made lifestyle less difficult with their bankruptcy Resource. It was speedy and simple to finish. If you find yourself Completely ready, I remarkably advocate starting out with Upsolve.

Just before attempting to get internet an auto mortgage, it is very advised that you comprehensively take a look at your credit report. Every rating within the Equifax, TransUnion and Experian credit score stories is highly applicable to how lenders perspective the creditworthiness in their probable borrowers, and as a consequence the phrases and motor vehicle loan fees they increase.

There are some issues to check for inside the personal loan contract, right before it is finalized. 1st around the checklist is More hints prepayment penalties, which limit your power to pay out back the mortgage in advance of agenda.

Generally you must exhaust your solutions in advance of having the drastic move of declaring bankruptcy.

Damaging details: Negative information, for instance late payments or significant credit rating utilization, can damage your rating. When you can’t dispute adverse facts that’s precise, you are able to identify and end destructive habits Which may be dragging your rating down.

This lets you maintain your automobile, regardless of whether it's over the exemption limit. Having said that, redeeming your vehicle can be costly and typically click now unfeasible when filing for bankruptcy.

Credit Ranking & Studies – The Clerk’s Business with the U. S. Bankruptcy Court docket isn't chargeable for credit rating studies or the information noted by credit history bureaus. Bankruptcy records are community data and the data contained in them may be retrieved by any individual.

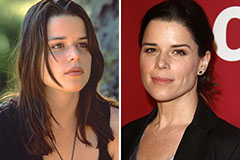

Neve Campbell Then & Now!

Neve Campbell Then & Now! Mackenzie Rosman Then & Now!

Mackenzie Rosman Then & Now! Macaulay Culkin Then & Now!

Macaulay Culkin Then & Now! Megyn Kelly Then & Now!

Megyn Kelly Then & Now! Ricky Schroder Then & Now!

Ricky Schroder Then & Now!